If you have the desire to study in Germany but don’t have enough financial resources then you can get an education loan from Indian banks. The state bank of India and many other national and private banks are offering education loans to students who want to study abroad.

The purpose of this education loan is to provide financial support on affordable terms and conditions to deserving/meritorious students. So that they will be able to pursue higher education in India or abroad.

How much money is required to study in Germany?

Tuition Fees: Normally German public universities are offering tuition-free courses to international students. But, some universities charge a little amount as a semester fee. This fee can be between 350 to 700 euros.

Private universities in Germany charge full tuition fees. So, if you want to study at a private university then you can check their fee structure.

Living Expenses: Along with tuition fees, you also need money for living expenses. The standard amount (set by the German Government) for living expenses for international students is 934 euros per month. So, you need 11,208 euros (934 x 12) for living expenses for one year. According to German law, you will deposit this amount (11,208 euros) in a blocked account. You will be able to withdraw 934 euros each month after arriving in Germany.

In total, you need 12,258 euros (Approx. Rs. 11 Lacs) including tuition fees (350 x 3 semesters = 1,050 euros) and living expenses (861 x 12 months = 11,208 euros).

Which bank is the most reliable to take an education loan?

The State Bank of India is the most trustworthy bank to take an education loan especially if you want to study in Germany. It’s the national bank of India so it can provide you with the maximum benefits.

Eligibility criteria:

- The student should be an Indian National and his age should be between 16 and 35.

- The student should have secure admission to a higher education course in a recognized German institution.

- The student should have a good academic career.

- The student should not have an outstanding education loan from any other bank or Institution.

- Parents (Father/Mother) should be co-borrower.

- A branch nearby to the permanent residence of the student will consider the loan.

Loan-eligible courses:

- Job-oriented bachelor degrees or professional/technical courses offered by reputed German universities.

- Master degrees such as MBA, MCA, MS, MSc, etc.

- Courses conducted by CPA in USA, CIMA London, etc.

- Phd studies

Where students can use this education loan?

Students can use this education loan for the following things:

- Tuition fees (including examination, library, or laboratory fees) of school, college, or university.

- Hostel expenses include rent deposit, building fund, etc.

- Purchase of course books, educational equipment (computers/laptops), educational instruments, and uniforms.

- Any kind of travel expenses incurred to study abroad.

- Life Insurance Premium for life cover of applicant student/co-borrower.

- Any other expenses which are necessary to complete the course such as study tours, labs, project work, and thesis, etc.

Processing charges:

The following processing charges will incur if you take an education loan from the state bank of India:

| Limit | Charges |

|---|---|

| Up to Rs. 20 Lacs | No |

| Above Rs. 20 Lacs | Rs. 10,000 + taxes |

The interest rate on this education loan:

The state bank of India give education loan at the following interest rate:

| Limit | Purpose | IR* |

|---|---|---|

| Upto Rs. 7.5 Lacs | Study abroad (bachelor/master) | 8.65%** |

| Above Rs. 7.5 Lacs | Study abroad (bachelor/master) | 8.65%** |

| Up to Rs. 40 Lacs | Scholar Loan | 6.85% – 8.15% |

**0.50% concession in interest for female students

Margin (the gap between the amount of money borrowed and the worth of the collateral):

| Limit | Margin |

|---|---|

| Up to Rs. 4 Lacs | No or zero margins (no collateral or security) |

| Above Rs. 4 Lacs | 15% for studies abroad |

Collateral (security for repayment of education loan):

| Limit | Collateral |

|---|---|

| Up to Rs. 4 Lacs | Parents or guardians apply as co-borrower. Students don’t have to show Collateral Security or a third-party guarantee to take this much loan. |

| Above Rs. 7.5 Lacs | Parents or guardians apply as co-borrower and students must show tangible collateral security such as house, land, etc. |

Tenure of the loan:

The tenure of the loan is 15 years starting one year after the completion of the course. It also includes a repayment holiday of 12 months.

Required documents:

- The following documents are required in order to apply for a student loan:

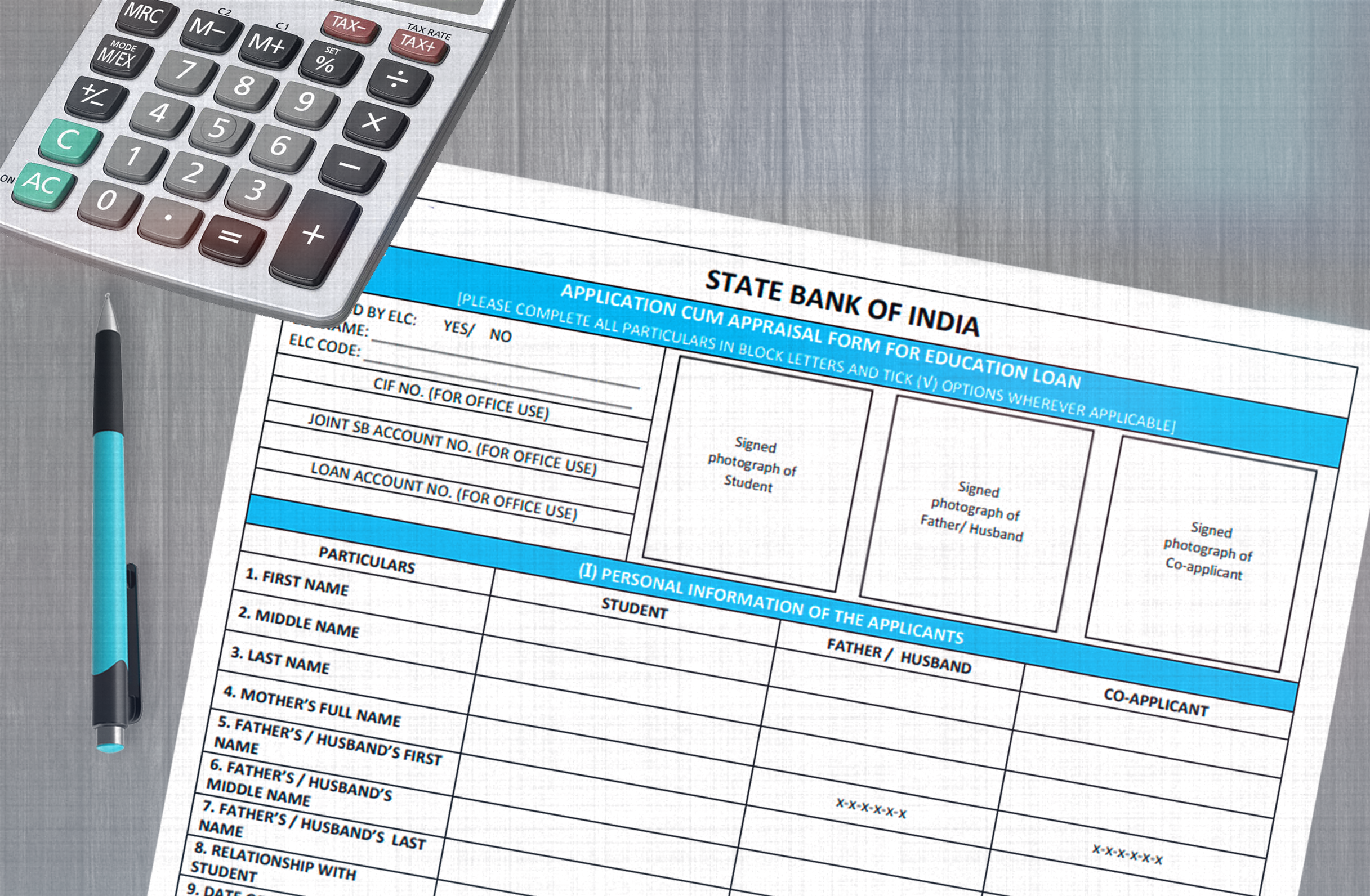

- Duly filled Loan Application Form.

- Mark sheets of 10th, 12th, and Graduation

- Entrance test result (if applicable).

- Proof of admission to course (Offer Letter/Admission Letter).

- Expenses schedule of the chosen course.

- Gap certificate (if applicable).

- Passport size photographs of Student/Parents/Co-borrower/Guarantor (1copy each).

- Asset Liability Statement of Co-borrower/Guarantor (Applicable for loans above Rs 7.50 lacs).

- Salaried persons show the latest Salary Slip (if applicable).

- Nonsalaried persons show the business address as proof and show income return (if applicable).

- Bank statement (for the last six months) of Parents/Guardian/Guarantor.

- Copy of Sale Deed and other documents of title to the property in respect of immovable property offered as collateral security/Photocopy of Liquid Security offered as collateral.

- Permanent Account Number (PAN) of Student/Parent/Co-borrower/Guarantor.

- Attested copy of AADHAAR card/Driving license or Voter’s Identity Card.

- Passport (mandatory for Studies Abroad).

Procedure to take education loan in India:

- First, secure admission to a German university and get an admission or offer letter.

- Prepare above mentioned documents and apply to the nearest branch of the State Bank of India.

Can I work in Germany along with my studies and repay my loan?

Non-EU students are allowed to work 120 full days or 240 half days in a year. So, you can work part-time (along with your studies) or full-time (in semester breaks) and earn money in order to pay back your loan. Students can easily earn 5-7 euros in a year with part-time or full-time jobs.

How can I get admission to a German university and apply for a student visa?

Read this article. It has all the information about the admission and visa process.

FAQs:

Which assets students can show as a security to take a loan?

Answer: Land, building, Government securities, Public Sector Bonds, NSC, KVP, LIP, Bank’s Term Deposit, etc.

If you have any questions then ask at GSG Forum.